How did Amazon’s product strategy fare during the pandemic? (Short answer: Amazon’s product strategy example lead the way)

Amazon’s product strategy example has rewritten the book on convenience, easy access, and speed, and in doing so, embedded itself in the daily lives and routines of consumers. However, even the conscientious objectors among us might not realize that they are indirectly purchasing from Amazon via Amazon Web Services (AWS) or its many subsidiaries.

Love it or hate it, Amazon’s product strategy works. It has fully integrated itself into the daily lives of ordinary people, knowing the intimate details of what we order in the middle of the night (e.g., foot fungal cream, a family-sized bag of chips, and a pair of sweatpants) and the apps and services supported by AWS. As a result, we’ve come to depend on Amazon to lighten the load, deliver convenience, entertainment, and satisfaction in just one click.

Amazon has been a subtle disrupter to spaces, markets, and basic daily life routines — significantly transforming how, where, and when we consume.

We set out to understand how Amazon responded to unprecedented demand for goods and services during a global pandemic. By unpacking Amazon’s product strategy, we endeavored to see whether or not the company stayed true to its core vision and mission when put to the ultimate test.

Here’s what we learned:

From Bookish Beginnings to Literally Everything on Earth

The company we know as Amazon launched in 1994 as Cadabra. Within months it was renamed after the “largest river by discharge volume of water in the world.”

Amazon was a disrupter from day one, and the space it was disrupting was bookselling. The field marked its last groundbreaking innovation around the time of Guttenberg circa 1436. Then, the invention of the printing press revolutionized the communication of ideas. Even today product teams understand how important it is to address communication issues, which can impede the flow of innovative ideas.

An online marketplace for books was an extension of that revolutionary spirit. In 1995, books were nothing if not physical, and so too were the places we found books: Bookstores, libraries, les bouquinistes if you happened to be in Paris.

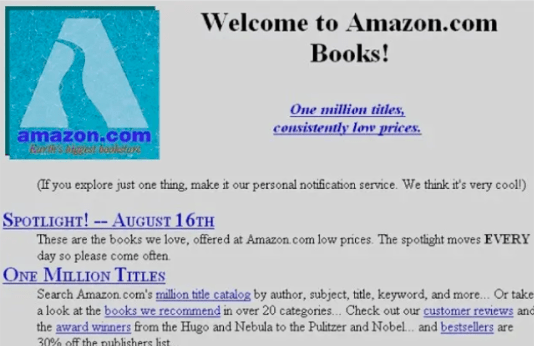

Here’s a look back at the company homepage circa 1995:

(Take a walk down memory lane with more vintage Amazon snapshots.)

“Amazon quickly became the leader in e-commerce. Open 24 hours a day, the site was user-friendly, encouraging browsers to post their own reviews of books and offering discounts, personalized recommendations, and searches for out-of-print books.”

Amazon is a multinational technology company known worldwide as a mega e-commerce marketplace. The company makes tablets and phones and provides digital streaming. Moreover, they are the go-to for on-demand cloud computing platforms and APIs.

How did this upstart go from a novel e-commerce bookseller to a household name and abroad? Like all great products, it starts with one person.

While Jeff Bezos, founder, and CEO of Amazon.com, Inc., was still working as a senior VP of an investment bank, he explored the investment potential of the internet. Not long after, he and a handful of employees launched an e-commerce bookselling company from his garage.

An evolution in Amazon’s product strategy

Eventually, Bezos realized that diversifying from strictly selling books to a broader product offering was the intelligent move in Amazon’s product strategy. So soon, electronics, clothing, and hardware intermingled with books. Then in 2006, Amazon added AWS to the product mix. And in 2007, the Kindle, Amazon’s digital book reader, was launched. Amazon’s product strategy helped the organization gain a monopoly on all things books. Bezos came full circle to his original product idea: bookselling—fully digital.

Amazon also owns over 40 subsidiaries, including IMDb, Zappos, Twitch, Audible, Ring, Whole Foods Market, AbeBooks, Goodreads, and, of course, Amazon Web Services.

AWS, the largest cloud-computing service in the world, is considered to be Amazon’s powerhouse subsidiary. It provides:

“on-demand cloud computing platforms and APIs to individuals, companies, and governments, on a metered pay-as-you-go basis. These cloud computing web services provide the various basic abstract technical infrastructure and distributed computing building blocks and tools. Amazon markets AWS to subscribers to obtain large-scale computing capacity more quickly and cheaply than building an actual physical server farm. All services are billed based on usage.”

About half of Amazon’s operating income in 2018 came from AWS, which has more than 1,000,000 active users. Here are just a few:

Aon, Adobe, Airbnb, Alcatel-Lucent, AOL, Acquia, AdRoll, AEG, Alert Logic, Autodesk, Bitdefender, BMW, British Gas, Baidu, Bristol-Myers Squibb, Canon, Capital One, Channel 4, Chef, Citrix, Coinbase, Comcast, Coursera, Disney, Docker, Dow Jones, European Space Agency, ESPN, Expedia, Financial Times

Interestingly, AWS was “initially developed to solve an internal constraint at Amazon.” Once the company built the infrastructure, “Amazon could sell incremental excess capacity to third parties like private companies and government.”

Watch our webinar on how to treat your strategy as a product:

Growth in numbers

In 1995, Amazon’s yearly net sales rang in around $510,000. Just three years later, sales rose to $600 million. In 2008, millions shifted to billions with $19.1 billion and nearly $233 billion in 2018. That’s some impressive growth

Today, Amazon is the largest internet company by revenue globally — $386.064 billion in 2020. According to eTail, there are 310 million active Amazon customer accounts worldwide. Furthermore, 90 million Amazon Prime members spend an average of $1,300 per year on the platform.

Amazon’s patent portfolio has seen a mega growth trajectory. In 2010, the company’s portfolio had fewer than 1,000 active patents.

By 2019, it had grown to nearly 10,000. Louis Columbus, a contributor at Forbes, notes that “Amazon’s patent portfolio is dominated by Cloud Computing, with the majority of the patents contributing to AWS’ current and future services roadmap.

In addition, Amazon is the second-largest private employer in the U.S. It also ranks as one of the world’s most valuable companies. Those are some impressive stats; considering the break-neck speed of technological innovation and growing competition, Amazon continues to impress with its product strategy.

Download The Product Strategy Playbook ➜

The Two-Pizza Rule: Team Structure and Product Management at Amazon

Amazon’s team structure follows a self-described two-pizza rule. Amazon’s goal is to keep its internal teams lean and able to move quickly. The name comes from the idea that no team should be so big that two pizzas couldn’t feed everyone.

“We try to create teams that are no larger than can be fed by two pizzas. We call that the two-pizza team rule.”

Amazon believes that smaller teams lead to better collaboration and communication. A focus on these two attributes enables teams to deliver new products and features quickly. For Amazon, speed is a critical competitive differentiator.

The role of Amazon product managers

As for product teams, Amazon Product Managers are embedded at various levels of the business. Eric Franklin, VP of Product at Spiketrap and former senior product manager at Amazon and Goodreads, writes, “Amazon is notorious for living and breathing quantifiable data, and you will live and die by the quality of your planning and your ability to execute over a substantial period.”

Franklin continues:

“The product team I was on had a dedicated development team and, therefore, a set of resources. For initiatives where we required work from other teams, we used our twice-a-year product plans to try and get on their respective roadmaps. It helps if you’re drafting on one of the core strategic goals of the company for that year, and you can make the other team see that you’re helping their stated goals as well. Assuming you’re doing big things that move the needle and people believe you can do what you say you’re going to do, this works pretty well. If you’re working off of a flimsy business case that nobody believes, you will generally not get resources from another team. It’s common to make arrangements where you supply your development resource to work within another team (with their senior development leadership/code reviews/etc.) to get a feature done.”

Cross-team product initiatives require quantifiable data that makes a compelling business case. The initiatives should align with the core strategic goals of the company. While small, autonomous teams are the norm, occasionally, initiatives involve multiple teams. Data, however, remains a constant guide across the organization.

The Amazon experience

John Rossman, author of Think Like Amazon: 50 1/2 Ideas to Become a Digital Leader, writes: “The Amazon experience shows us that the single biggest opportunity for companies operating Today is to rethink their concept of metrics completely. Today, you need real-time data, real-time monitoring, and real-time alarms when trouble is brewing—not lag-time metrics that hide the real issues for 24 hours or longer.”

Technical and non-technical PM roles

Amazon has both technical and non-technical PM roles and holds a very high standard for UX research. A Senior Product Manager job posting highlights these attributes for potential candidates:

“Product Management at AWS is an opportunity to collaborate with engineering, design, and business development teams. We are looking for an entrepreneurial product leader passionate about delivering solutions to customers and excited about growing a new AWS business. Successful candidates will be able to build a strategic roadmap for the business, dive into technical details working closely with the engineering team and drive the delivery of features that will delight our customers.”

Accountability and empowerment fuel an agile environment

Customer obsession weaves through every nook and cranny at Amazon. A combination of accountability and empowerment fuels the company’s high-performing agile teams. Tom Godden, Enterprise Strategist and Evangelist at AWS, explains: “Accountable employees manage their workload according to team objectives, proactively seek help when they need it, take responsibility when they make mistakes, and do so in an environment where they are empowered and given the authority to do something.”

According to Godden, successful product leadership comes down to having a leader solely dedicated to a product.

As a rule, Amazon organizes its small teams around products. Godden writes that “accountability and empowerment clear by focusing their scope, providing dedicated resources, and establishing clear objectives.” He continues to state that “product teams are responsible for everything from ideation, through engineering, testing, and deployment, all the way into operations and maintenance.

Amazon’s Product Strategy: A Customer-Centric Company Built on Day 1 Startup Culture

Four fundamental principles form the foundation of Amazon and continue to guide the company:

- Customer obsession

- passion for invention

- operational excellence

- long-term thinking

Amazon’s mission is to strive to offer customers the lowest price, the best selection, and the utmost convenience. The company’s vision is “to be Earth’s most customer-centric company, where customers can find and discover anything they might want to buy online.” Amazon’s mission and vision statements guide both the company’s product strategies and business goals.

Bezos has in recent years pushed to cultivate a Day 1 startup culture throughout the organization to stay customer-centric. For example, in a letter to shareholders in 2017, Bezos wrote: “What does Day 2 look like? Day 2 is stasis. Followed by irrelevance and followed by severe, painful decline. Followed by death. And that is why it is always Day 1.”

According to the article Inside Day 1: How Amazon Uses Agile Team Structures and Adaptive Practices to Innovate on Behalf of Customers, “customer obsession and quick decision-making are key to avoiding organizational stasis and are essential for maintaining Amazon’s unique Day 1 culture. These two factors have enabled Amazon to rapidly go-to-market with its innovative products and services.”

Cultivating a Day 1 culture within the company invites flexible thinking and maintains a customer focus. Additionally, Day 1 culture is associated with growth, risk-taking, and creativity, which dovetails perfectly with an agile development environment.

Why working backward is the way forward.

The organization used a Working Backwards approach to design and track Amazon’s product strategy. This concept is a product development approach that starts with the team imagining the product is ready to ship. The product team’s first step is to draft a press release announcing the product’s availability. The audience for this press release is the product’s customers.

Using the working backward method fits perfectly with Amazon’s customer-centric approach. The product team needs to think through all of the reasons it built the hypothetical product, so it can draft a compelling news release to announce the release in a way that would convince the target customer to run out and buy it. Unless the product team has been customer-obsessed in writing the press announcement, that document won’t make a case for them to build the product.

In Defining Strategy with Amazon’s Product Manager, Carlos de Villaumbrosia, CEO of the Product School, interviewed Virgilia Kaur Pruthi, Principal Product Manager at Microsoft, about her experiences in her previous role as Strategy and Product Management at Amazon Business. Here’s an excerpt of that conversation:

As a strategy leader at Amazon, how do you reconcile your vision of where the product should go with the “on the ground” PMs who own their discrete product areas?

It’s the same. First, we have to think about the vision 3–5 years out as a team. Then, each organizational team must align its work with that vision. Work backward from there.

What is your thought process for creating a product strategy in your current company?

It would help if you started with a positioning document. Think about what vision you’re trying to achieve, what are the metric-driven goals you are setting, which stakeholders need to sign off, who your target customers are, why are you the best-suited company to solve this problem, and think through all the questions your stakeholders may ask you and begin answering them.

While defining a product roadmap, how do you tackle risks? Whether Would users be interested in a feature? Do you do an internal A/B test on some users first to determine if the feature is worth investing in and then finalize it into a roadmap?

A lot of testing, either qualitative or quantitative or a mix of both. It’s a combination of that and a blend of our gut feel.

How do you decide what is the next big product idea or what to launch next? And how do you convince management of it?

I know I sound like a broken record; however, you will figure out that big idea if you know your customer in and out. Think about what would make their lives easier, what causes the most pain, and aim to solve that. Convince management by showcasing your metrics and how it aligns to their overall company vision.

Full steam ahead?

Amazon recently announced its plans to acquire MGM Studios, its second-largest acquisition after Whole Foods in 2017. Adding MGM Studios expands Amazon’s Prime Video streaming service, which was introduced in 2011 and had more than 200 million subscribers, and put the company in a position to be a serious competitor to video streaming giants like Netflix and Disney+.

According to Amazon, however, the real value of Amazon Prime Video is all about customer loyalty. Including a video, the service encourages Prime members to continue their subscription and to purchase with Amazon. As a result, households with Amazon Prime subscriptions typically spend significantly more than non-Prime members. In addition, Prime Video users are more likely to renew their subscriptions or pay for a new subscription following a trial, purports Amazon.

Not everyone sees Amazon’s latest and largest acquisitions as sound strategies, however. Shira Ovide, On Tech writer for the New York Times, writes:

“Amazon’s success in online shopping and cloud computing — and, importantly, the belief among both fans and detractors that the company is a powerful and disruptive genius — has papered over Amazon’s questionable strategies in groceries and streaming. And it has reduced the urgency to fix a clunky online shopping experience that we can’t always trust, and that feels as if it hasn’t been updated since the 1990s.”

Global Pandemic Ushers in Heavy Use and Dependency

It’s abundantly clear that Amazon is the undisputed one-click provider of everything under the sun, making it the dominant option in every market. And the more it dominates, the more it eclipses the competition, strengthening Amazon’s market share.

Before the pandemic, Amazon was already a mainstay. When the world went into lockdown overnight in March 2020, Amazon became a lifeline.

The explosion in demand shot up overnight — from food and beverages to exercise equipment, games, and office supplies (and while it was still available — toilet paper). People avoided shopping in public, opting instead for safer online options like Amazon. With gyms closed off and on for the better part of a year, consumers bulked up their at-home equipment. When movie theaters and entertainment venues went dark, people — starved for distractions from the strain of pandemic life — turned to video streaming.

Amazon increases market share during the pandemic

Kiri Masters, a contributor at Forbes, writes: “2020 was an incredible year for Amazon. The pandemic gifted Amazon more market share and sales volume than ever before. As a result, EMarketer estimates that Amazon increased its share of e-commerce sales to 38% in 2020, up from 37.3% in 2019.”

Perhaps not surprisingly, then, in 2020, Amazon registered record profits. The company’s record-breaking revenue in the fourth quarter of 2020 exceeded over $100 billion, which the pandemic was a contributing factor. “The unprecedented numbers were, in part, caused by a rise in home shopping during the COVID-19 pandemic.” (Brittanica.com)

Ever striving to be “Earth’s Most Customer-Centric Company,” Amazon met the unprecedented demand for goods and services by ensuring fulfillment stayed steady and robust. In a sense, it carried on business as usual by being customer-obsessed.

With lockdowns in place and concerns about contagions in public spaces, customers needed reliable access to goods and services and delivery of those goods to their homes. Amazon delivered on both counts, as it had already proven itself capable of doing in the years leading up to the pandemic. They have a proven track record.

Of course, the uptick in demand was the ultimate test. Amazon added more than 400,000 workers in the U.S. alone in 2020. In response to rising demand, the company added 50% more warehouse space last year.

Masters explains: “2020 was a year where Amazon’s multi-year investment in fulfillment and delivery infrastructure shone. As a result, Amazon’s logistics systems stood up to the challenge of an avalanche of online orders in 2020.”

The Future Is Sticky

Amazon has cornered the market on almost everything on Earth, and soon, beyond. Its formula remains constant: A heavy dose of customer obsession, followed by competitive differentiation and data centricity.

Amazon gives consumers precisely what they want: the lowest prices, the best selection, and the utmost convenience. That’s the secret sauce that is what makes it so sticky. Busy, stressed American consumers need easy, convenient access to goods and services, and this is why Amazon is the largest internet company by revenue in the world.

But with great power comes great responsibility. And we’ll add further opportunities.

Amazon’s own four guiding principles come into play, namely long-term thinking and passion for invention. As a result, the company stands to lead in innovations, products, packaging, and logistics.

Amazon has the power and influence to significantly impact the worldwide stage to encourage the creation of sustainable products that last, innovating packaging (i.e., compostable, recycled materials, recyclable, etc.), and building delivery fleets that run on electricity.

Amazon’s number-one priority has always been to deliver on customer obsession. But can the company predict and provide future customers really need?