What is Customer Acquisition Cost (CAC)?

Customer Acquisition Cost, or CAC, measures how much an organization spends to acquire new customers. CAC – an important business metric – is the total cost of sales and marketing efforts, as well as property or equipment, needed to convince a customer to buy a product or service.

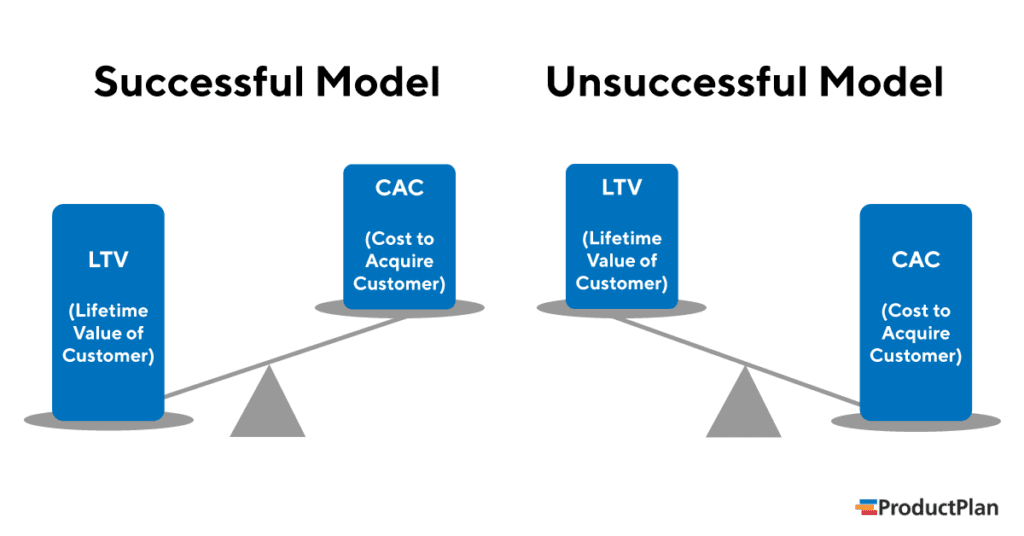

Analyzing CAC in conjunction with Lifetime Value (an estimate of how much revenue an account will bring in over its lifetime by continuing to purchase or subscribe for a longer period of time) or Monthly Recurring Revenue (the measurement of revenue generation by month) is a common way to discover whether or not a company is operating efficiently.

Why is CAC important to product management?

Customer Acquisition Cost helps a company calculate the overall value of a customer to the organization. It also helps calculate the resulting ROI of an acquisition.

Jordan T. McBride of ProfitWell writes:

“Customer acquisition cost is designed to measure and maintain the profitability of your acquisition teams. If your costs to get the customer through the door are higher than your Customer Lifetime Value, then the business cannot be viable. The best rule of thumb is to be spending 33% or less of your customers’ lifetime value.”

How do you calculate CAC?

Calculate CAC by dividing the total expenses to acquire customers (cost of sales and marketing) by the total number of customers acquired over a given time. Effectively calculating CAC falls into two categories: simple and complex.

Here’s the simple method for calculating CAC: CAC = MCC ÷ CA

MCC: Total marketing campaign costs related to acquisition

CA: Total customers acquired

Here’s the complex method for calculating CAC: CAC = (MCC + W + S + PS + O) ÷ CA

MCC: Total marketing campaign costs related to acquisition

W: Wages associated with marketing and sales

S: The cost of all marketing and sales software

PS: Any additional professional services (e.g., consultants) used in marketing/sales

O: Overhead

CA: Total customers acquired

3 Tips to Reduce CAC

Here are three customer-centric tips to help you reduce Customer Acquisition Costs and optimize profits:

- Know your customer. Knowing your customer’s wants and needs help you create a product that will delight them.

- Engage customers early. Earlier product engagement lowers acquisition costs per customer.

- Keep them coming back. Create a positive customer experience because acquiring a new user is much more expensive than keeping an existing one.

Related terms: Monthly Recurring Revenue, Lifetime Value, Churn, User Experience, Customer Empathy, Product Excellence.