What Is Lifetime Value (LTV)?

Lifetime value (LTV) estimates how much revenue a customer represents a business over the life of that relationship. Also called customer lifetime value (CLV, or CLTV), this is a critical metric for a company trying to gauge the cost efficiency of acquiring new customers and supporting them over time.

Why Is Knowing Your Customers’ Lifetime Value Important?

Understanding the LTV of your customers can provide valuable insights to help you run your business more effectively and profitably. Here are a few examples.

It tells you if you’re connecting with your market.

Several metrics can give you a sense of whether your products or your company are resonating with customers. One example is your Net Promoter Score (NPS). But most of these metrics, including NPS, give you only an indication of how positively (or negatively) customers feel toward your company. Those feelings don’t always translate directly into revenue and profit.

Obtaining an accurate estimate of customers’ LTV gives you a much clearer picture of your products, marketing, and sales processes, and how your brand is translating into long-term revenue.

It tells you when a customer will become profitable (which could take longer than you think)

Suppose a business focuses only on the revenue generated by a new customer’s first purchase. In that case, it could make a strategic error in deciding that a given product, marketing campaign, or customer segment is not profitable. But what if many of those customers will go on to buy more from that business over time?

In reality, the marketing campaign or initial purchase that brings your customer in the door could lead to a profitable long-term relationship, even if it appears to be a money-losing venture in the short term. You will learn this only if you project your customers’ lifetime value.

It tells you which personas to invest in

Different segments of your customer base will represent different LTVs to your company. Knowing this will help you allocate resources for product development, marketing, operations, and other costs more intelligently. You will be able to devote more resources to the segments of your user base that will deliver more revenue to your business over time.

How Do You Calculate LTV?

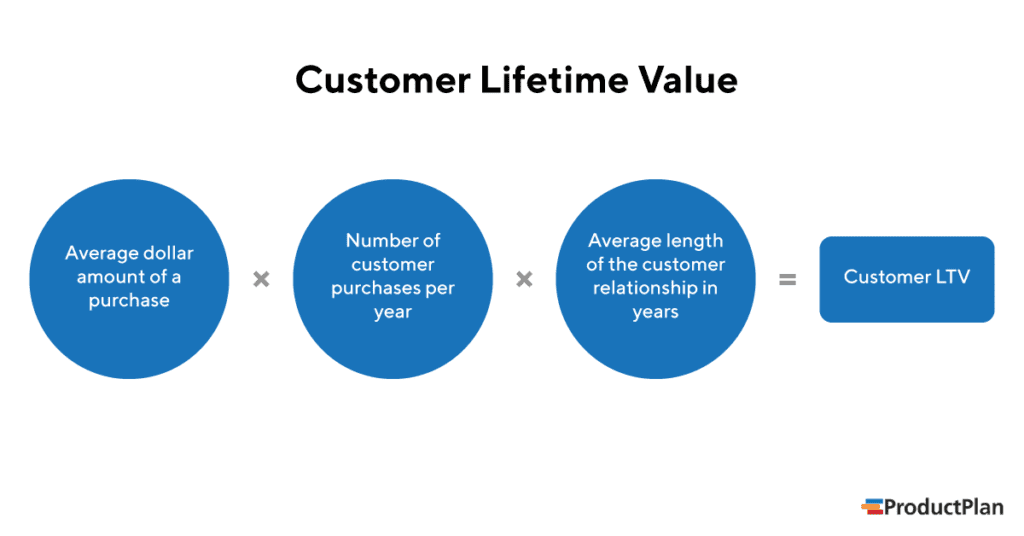

According to Amazon’s Alexa blog, the basic LTV formula looks like this:

Note: As we pointed out above, you will want to segment your customer base into several categories first—by industry, by the size of the customer’s company, etc. Then you will want to perform these calculations for each segment. This will tell you in which of those segments it will make more sense to invest, and which segments could be costing your company more than they’re worth to acquire or support.

Download Product Success Metrics ➜

How Can You Increase Your Average Customer’s LTV?

Here are a few best practices for boosting LTV.

1. Improve your onboarding process

One reason your customer LTV might be lower than it should be is that new customers find your product challenging to learn and use. If you sell a SaaS application, for example, the ease of your onboarding process is critical. Customers who become frustrated the first few times try to familiarize themselves with your product are less likely to stay with that product for long.

By contrast, a user-friendly and pleasant onboarding experience can make new customers immediate fans of your products and your company. That can lead to several positive follow-on effects. These customers will be more likely to stick with your product for the long term. They’re more likely to become champions of your product to coworkers across their company. They’re also more likely to be interested in the other products you offer.

Dive Deeper:

Is Product Training Part of the Product?

2. Deliver outstanding support

Another way many businesses undermine their LTV is by failing to provide excellent support for customers. A key strategy for maintaining a long-term relationship with customers is to make sure your team is there for them when they need help.

This is why it’s essential to make sure your customer support is world-class. As a product manager or product leader, you can do this by making sure your support team receives training and information on new products and all updates to existing ones. We recommend involving members of the support team in your product, sales, and marketing discussions more often. This will help your support reps better understand who your customers are and what problems they’re buying your products to solve.

All of this will help make these reps more effective and empathetic when customers call—which will increase the likelihood that they will stay customers over a longer timeframe.

3. Surprise and delight your customers

One final suggestion for increasing average LTV is to periodically give your customers something positive that they aren’t expecting. Suppose you sell a B2B SaaS app, for example. In that case, you might want to automatically upgrade longer-term customers to a higher-level service, or let them know you’re giving them free use of a new widget be selling to new customers.

This is particularly valuable for accounts whose usage has fallen off. Those are the customers likely to cancel their subscriptions or, at best, not renew them when the current term expires.

But for any customer, delivering a positive surprise now and then is a great way to keep that relationship going—and add to that customer’s LTV.

Related Terms

customer acquisition cost (CAC) / churn / monthly recurring revenue (MRR) / key performance indicator (KPI)/ product-market fit

Learn More Ways to Measure Your Product’s Performance

Read our book

The Product Success Metrics