Product pricing can make or break a product. It’s not just the sticker price, either. The packaging of features and sales models also influence a product’s growth and profitability. Deciding to go with a Software-as-a-Service (SaaS) pricing model is no longer particularly revolutionary. Even Microsoft took the plunge and adopted rent-versus-own pricing for its ubiquitous Office suite.

But SaaS isn’t a one-size-fits-all choice. There is a surprisingly large number of ways to bundle and price a SaaS product, which many have learned the hard way. This choice can have significant ramifications on adoption, churn, and cash flow. It also impacts account management and administrative overhead.

10 Examples SaaS Pricing Models

Figuring out which pricing strategy to pursue is the first step in the pricing journey. To help plot a course for success, we’ve broken down ten options for SaaS pricing models:

1 . Flat Subscription

A flat subscription model is simple: one product, one price. It’s the all-inclusive vacation of SaaS product pricing models. For example, Basecamp charges $99 per month for unlimited seats and its entire suite of features.

Flat subscriptions are transparent and let buyers relax. They know there won’t be any surprise charges or hidden usage fees lurking in the shadows. There’s no need to pick and choose features or worry you didn’t purchase the right plan. This subscription simplifies the sales process.

Its strength is also its shortcoming. Lumping everything into an attractive, single package removes the opportunity for further upselling. Increased usage within the customer can’t be leveraged for extra revenue. Plus, it’s trickier to find that perfect price point. It must be low enough to attract small businesses yet high enough to avoid exploitation by a more significant customer.

A flat subscription is ideal for a consumer-focused product. An individual customer can only use so much, plus it decreases the complexity of the purchase decision. It’s also great for relatively simple products that don’t boast too many features.

2. Per-User Pricing

Each user costs X amount of money, and they get access to the entire product. Salesforce.com was a huge proponent of this model, with per-seat pricing for Sales Cloud and Service Cloud offerings.

Per seat’s simplicity is a significant advantage. Customers understand how much it will cost, plus they can try one or two seats before making a major commitment. For vendors, it makes for a very predictable revenue stream. Those seats will mostly renew each month with no additional effort.

But charging per user limits how many people within an organization use the product. Since each seat costs more money, companies will dole out those seat licenses sparingly. They’ll want to avoid unnecessary charges (plus, you might encounter some “shared credentials” to save a buck).

More importantly, per-user pricing doesn’t equate the cost of the product with its value. Instead of pricing for the benefits it offers, it’s using an arbitrary metric (seats) that doesn’t correlate to what it does. If a customer can extract the value by only having a few people use the product, the vendor gets shortchanged in the deal.

This SaaS pricing model works best tying the product’s value to how many people in an organization use it. This model shines if benefits are reduced when large swaths of the company do not adopt it. Some even claim this model is a recipe for killing the product’s growth.

3. Per-User with Free Participants

This pricing model is an offshoot of the previous model. Each user still pays a monthly fee, but there’s a different class of “user” (called a participant) with limited access. Typically, this is view-only access but could be any ratcheted down the level of functionality the company is willing to give away.

For an example of this SaaS pricing model, look no further than ProductPlan. We charge per user but allow an unlimited number of participants to view the roadmaps users create. We selected this model because we know the importance of everyone in the organization having access to roadmaps. Charging every employee for read-only access would be a showstopper, thus this compromise.

The upside to this model is that more users may be added once they get a “taste” via the participant-level access. It also creates a viral effect. Lots of people get to see the finished product and might request full access or recommend it to others.

The downside is that limited access may be sufficient for most of the organization. This downside then caps the total addressable market for each customer.

This model works best for products with two classes of people within a customer account. For example, GoToMeeting charges for each account with “meeting room” control but not for those who join meetings.

4. Freemium

Freemium is one of the most popular SaaS pricing models. Everyone gets access to limited capabilities for free. Additional features reside behind a paywall.

Spotify and Pandora are examples of this model. Users can stream music for free but must pay to get rid of the advertisements and download music to their devices for offline playback.

The main benefit of this model is reducing the barrier to entry. Users don’t even have to enter a credit card to start experiencing the benefits of the solution. This facility can significantly accelerate growth and encourages trial, reducing the cost of acquisition.

The primary drawback is that many users may be just fine with the limitations of the free version. They’ll never pay anything to upgrade to a paid tier. If the company can monetize free users (via advertising, for example), then that might be fine. Otherwise, they need a ton of users entering the top of the funnel to get enough upgrades to make the numbers work.

Other problems can stem from the fact that free users might cost the company money. If they never “buy the cow” because they’re “getting the milk for free,” the company is still paying to feed that cow.

This model works best when the limitations of the free tier create enough friction that users eventually upgrade. Capping usage or storage and holding back key features is vital. Onboarding and customer nurturing should drive free users to paid tiers. Plus, the product must be sticky enough; they want to use it more.

5. Per Visitor/Traffic

Per visitor/traffic pricing is a utility model. Customers pay for how many people visit a site, click a link or an ad, or perform some other type of conversion. Google Ads is an example of this model, where the base payment on how many people see or click-through on an ad.

The advantage of this model is that customers are paying for results. Since they want those results, they don’t mind paying. And, if they see positive results materialize, they usually increase their spending because they want more.

The flaw in this model is that customers can quickly abandon the platform if they’re not getting results. This action might be due to the product not performing but can also stem from unrealistic customer expectations. Another negative is that both parties must exchange data, which can create security concerns or a barrier to adoption.

This model is best suited for advertising, lead generation, or sales-oriented solutions. It’s not a fit for any product that isn’t directly involved in those sorts of activities.

6. Free with Advertising

This model is straightforward. The company provides a product or service for free to users and serves advertisements during their user experience.

This model is one of the oldest pricing models on the Internet. It mirrors the age-old business models of radio and network television and is seen across the news and entertainment websites, social media, mobile games, YouTube, and even Google.

The primary advantage of this model is that it removes almost all barriers to adoption. People can start using the product and without being asked to pay for anything. It works best at scale. “Monetizing eyeballs” gains momentum when the audience grows and can be segmented.

But those same advantages can also be problematic. Without enough traffic and usage, advertising revenue is seldom enough to survive. There’s lots of pushback on sites targeting specific ads and content based on behavior, location, and demographics. Companies using this model also must continually fill the pipeline with revenue-generating advertisers.

This SaaS pricing model is a fit for extremely large media companies that draw large audiences. Social media titans also make their billions with this approach. But it’s not great for smaller firms still in their early days and building a following.

7. Broker Fee/Peer-to-Peer

This pricing model is for platforms that match buyers and sellers and take a commission on the resulting transactions. Companies like Airbnb and eBay, who don’t sell anything themselves.

These businesses can scale very fast without actually producing anything or carrying an inventory. They add value by establishing by building a community and offering reviews. They sometimes provide ancillary services, such as insurance or facilitating shipping.

To be successful, however, these marketplaces must achieve significant scale. You need a steady stream of transactions to keep the revenue flowing. There’s also the risk of buyers and sellers forming relationships outside the platform after making the initial connection. And, since the platform itself isn’t providing the product or service, there can be varying quality or even deliberate “scammers.” This risk can cast a negative light on the platform as a whole.

This model is only viable for vast marketplace opportunities. There must be both an ample supply of product or service providers and significant, frequent demand from buyers. Once dominant providers stake their claim, it is hard for new entrants to disrupt the incumbents.

8. Storage

Charging based on storage is a consumption-based pricing model. Customers pay for how much storage they’re using or purchase a specific amount in advance. Often these plans include a free tier of usage to get people hooked.

Companies use this model in the cloud storage business (such as Dropbox) and cloud computing (such as Amazon Web Services). Each charges monthly or annually based on how much storage is requested or used.

Pricing based on storage encourages trial. Initially, users are getting a benefit for free or a very low rate. There’s also the advantage that customers only pay for what they need. When they bump against the cap of whichever tier they’re using, it forces them to either pay more or delete something.

It has a clear growth path as customers will rely on this service and look to store more and more over time. Plus, there’s generally an increase in the overall amount of digital materials thanks to larger image sizes and more information requiring backup.

However, this model does run a risk. By providing enough storage for free, customers may never need to pay for a premium tier. In the meantime, there is a real cost to support all those free customers.

This SaaS pricing model applies to any business where the customer is storing data. But it’s the best fit for dedicated services such as cloud storage and computing.

9. Per Item/Contact

Similar to the storage model, this is also a consumption-based pricing strategy. The difference is on what they’re counting. While storage models count up the megabytes, these companies are charging per unit.

For a company like HubSpot or MailChimp, those units are contacts in mailing lists. Generally, these companies create tiers based on tranches of units. They sometimes offer the initial block of items for free to entice trial.

This model’s advantage lies in its simplicity. Customers understand what they’re paying for and why it’s crucial. Both parties are invested in the customer being successful, as the vendor makes more money when the customer creates more contacts.

The downside is that growth lies with the customers. If they’re not accelerating their business and adding more units, then the vendor isn’t making more money. This dynamic incentivizes the vendor to innovate continually. They must add new features to help customers grow their inventory of counted units.

This approach is suitable for companies offering a service with a naturally countable unit of value. That unit must tie to the customer’s usage and growth; otherwise, each account remains stagnant at best.

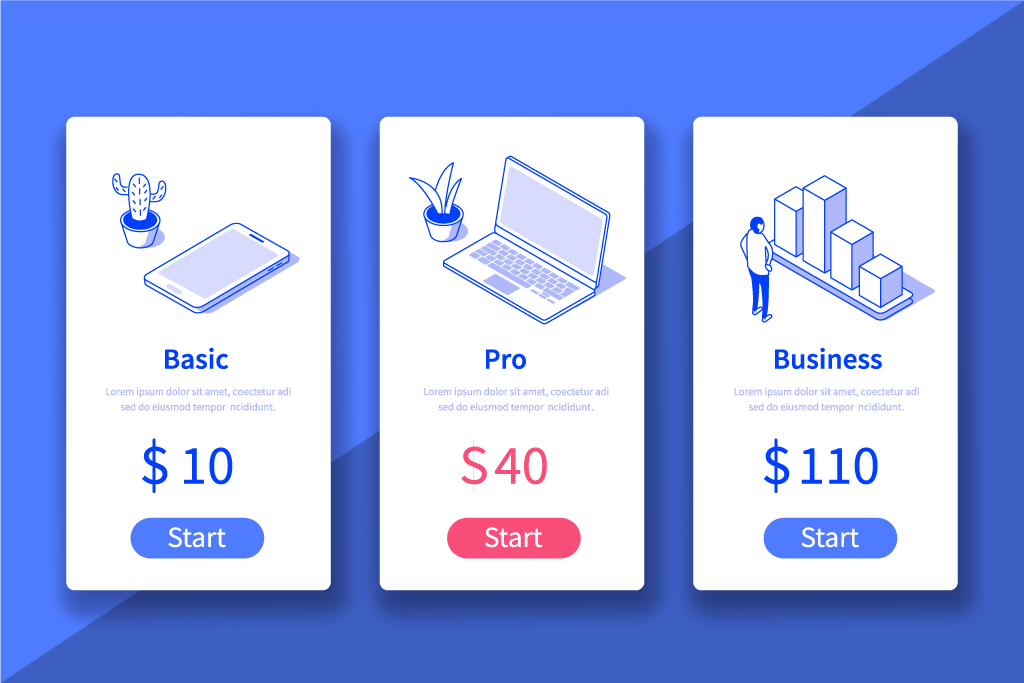

10. Tiered Versus Unit Pricing

Many of the models above price based on usage. In these cases, companies have the option to price based on each unit (i.e., each user, each gigabyte of storage, each transaction). They can also decide to price using tiers (i.e., up to 10 users, up to 50 users).

In general, tiered pricing is more profitable for companies. Customers seldom use up every last unit of the tier they purchase. As long as the introductory tier is low enough that it doesn’t scare prospects away, this is generally the best route to take. However, it can sometimes be more challenging to explain its complexipaddle.com/blog/the-tiered-pricing-modelties.

How to Choose the Best SaaS Pricing Model?

We covered ten SaaS pricing models, and that doesn’t even cover them all!

While it may seem obvious which model is a good fit for a particular product, there’s no reason to pick one and run with it. In today’s data-driven world, companies can test different models in controlled environments. They can see which one resonates with customers and makes sense before committing.

Ready to optimize your pricing strategy? Download The Power of Pricing Experiments.