The only true consistent figure in this process is product management. Product managers take the reigns as early as product definition and concept vetting. They bring it to life, nurture its growth, and ultimately put it to bed one final time.

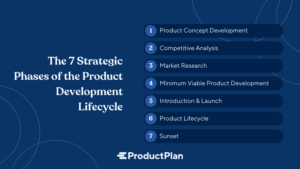

The 7 Strategic Phases of the Product Development Lifecycle

Before diving headfirst into any of the strategic phases of the product development lifecycle, it’s essential to understand all the steps. While mostly discrete activities, they do build on each other. A faulty foundation can result in a wobbly, flawed future.

1. Product Concept Development

This initial phase might be the most fun and creative stage in the product lifecycle, and it’s the most critical. Businesses come up with lots of ideas. So only the most promising projects must get the traction and resources they deserve.

So, once there’s an initial idea internal folks are excited about, it’s time to employ some of the available tools and techniques for some quick market validation. These tests give the team confidence they’re onto something with real promise.

A key step in this phase is product discovery. This process gives the product team a much deeper understanding of the problems potential customers face and the user personas the solution can target. Without a solid foundation of who the product is for and which of their pain points it solves, there’s little hope of finding product-market fit.

Armed with a good idea and a solid understanding of the key problem, the concept is then fleshed out while gathering additional information.

2. Competitive Analysis

If a company has stumbled onto a great idea, it’s likely they’re not the only ones to have this epiphany. That’s why the next step is surveying the landscape. You do this to see how the product concept compares to what’s already available or under development.

The goal here is to understand the other options potential customers already have. Sometimes there will be a direct competitor with a relatively similar offering. There may be broader solutions that include similar functionality to the product in question. An effective competitive analysis must include completely unexpected, less-than-elegant workaround solutions potential customers use to solve their pain points.

This includes using spreadsheets for building product roadmaps, authoring code in a plain text editor, or building animations in PowerPoint. People often use the tools they already have at their disposal. Changing those behaviors may be just as important and challenging as taking on direct competitors.

3. Market Research

Still not done with homework! Now that the business has a handle on how its solution fits into the scene, it’s time to see if its differentiated approach to solving user problems holds up.

Market research typically involves both qualitative and quantitative research. Surveys and aggregated data can indicate trends, help calculate the total addressable market, and serve as valuable input to the prioritization process.

Meanwhile, qualitative research can help product teams get to the “why” at the heart of the solution. Using focus groups, interviews, and other in-depth research methods. These methods add both color and a sense of humanity to the research and development process. An added benefit is that they challenge assumptions.

4. Minimum Viable Product Development

The tail end of the market research phase may also entail developing a Minimum Viable Product. An MVP is functional for gauging the reaction and interest of likely buyers. It only includes the most vital features and functionality based on the business’s understanding of which user stories customers need most. It is laser-focused on solving core problems.

During MVP definition and development, the team may begin employing prioritization frameworks. MVPs determine which items would deliver the most “bang for the buck” and must be in place for the initial product offering. Frameworks focused on core functionality versus product line expansion are a good fit at this time. Examples include the jobs-to-be-done framework, which ensures the business is building products customers actually want and use.

By getting something to the market quickly, the company can validate its concept and generate user feedback. This is crucial during these early stages. It serves to inform for adjustments to perform key tasks at launch, and the value proposition and messaging matches the offering.

5. Introduction and Launch

With “Version 1.0” about to become a reality, it’s time to take this idea to market. Even if it still bears a “beta” label. The hard work of generating awareness and demand often starts well before the “download” link goes live.

The product marketing team should be generating demand and building some buzz for the offering in anticipation of the release.

Using A/B testing on different messaging and price points to build up a list of interested parties and validate the value proposition’s efficacy. Press and analysts are briefed in advance and given product demos. This seeds the media market with coverage when the grand unveiling occurs.

A robust mechanism for soliciting, collecting, aggregating, and analyzing user feedback must be in place at launch. Asses the first impressions and the efficacy of different campaign messages and tactics. The results inform plans and how to allocate resources for wider promotion and growth.

Employing product analytics and customer research, product teams can begin measuring product-market fit. If gaps are identified, they can be added to the product backlog in preparation for future prioritization and product roadmapping activities.

6. Product Lifecycle

Mature products enter a new phase of existence. Typically, this is a cycle of iterative improvements and modifications. Interspersed with more significant expansions (or removal) of functionality and capabilities.

At this point, the product roadmap becomes indispensable. As processes mature, release cadences are established, and the focus shifts to enhancements and growth. KPIs, goals, outcomes, and objectives will evolve throughout the product lifecycle. It will shift based on both the success and struggles of the product as well as the organization.

While rarely boring, this is the most predictable and routine phase of the product lifecycle. Suppose the product continues to find traction and adequate growth while establishing profitability. This phase may last for years, if not decades assuming the product remains viable and there’s a persistent market for it.

To synchronize strategic objectives with resource allocation and development priorities, structure a product roadmap using themes. Themes are excellent to ensure efforts remain focused on what matters most. This method still gives the implementation team some latitude in an Agile development framework.

7. Sunset

All things must end. For some lucky product management professionals, this never happens on their watch. However, statistically, there’s a pretty good chance they’ll have to say goodbye to an entire product or major component at some point during their career.

This isn’t always a bad thing. In fact, it’s just an inevitable part of the strategic phases of the product planning process. It’s a phase in which you are retiring a product due to a superior offering’s arrival. Another reason is a dwindling need for a particular solution. This is because the problem is no longer acute enough to warrant a product.

But wrapping up a longstanding offering has many implications. Using a checklist can ensure all the aspects are properly addressed during the wind-down period.