What Is a Product Distribution Strategy?

Before discussing the various types of product distribution models, let’s define what we mean by a product distribution strategy. A product team will determine, based on research, which approach makes the most strategic sense to deliver its products to customers. A product distribution strategy encompasses all of the processes and methods a business establishes to execute this approach.

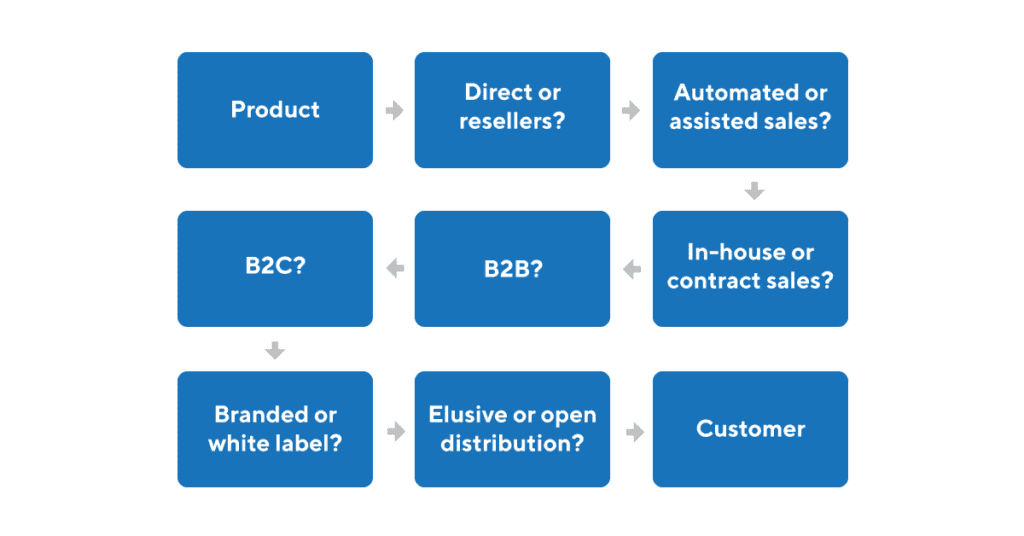

Here are a few examples of the questions a product team will need to answer in determining its product distribution strategy:

- Should we sell directly to customers or through resale partners?

- If we sell directly, should we automate the buying process or use a sales team?

- [For software]: Should we make our product available online or as a client-side install?

What Are Common Product Distribution Models?

There are several conventional product distribution models. A key component in deciding which makes the most sense for your product will be the type of customer you’re targeting. Let’s review several distribution models and discuss which customer profiles match each model.

1. Selling directly to customers with an assisted sales process

It is the standard in-house (or contracted) sales team, cold calling potential customers, or responding to prospect inquiries generated by marketing or ad campaigns.

When this makes sense:

- For B2B products: when the product is complex and requires several meetings, possibly involving technical personnel. The manufacturer might not trust that any resale partner would become expert enough to sell it as effectively as its in-house team.)

- For B2C products: when the product is expensive and/or a luxury item. The company might determine that the high-end customer they’re targeting would feel more comfortable buying from the luxury brand itself than from a reseller.

When this doesn’t make sense:

- For products that can be easily purchased automatically, such as apps or other software tools, which don’t require a lot of technical explanation or coordination. In these cases, hiring a full-time salesforce might be an unnecessary expense.

2. Selling directly to customers with an automated purchase process

This approach has become the norm for companies across many industries because online purchasing has become ubiquitous. Even sectors that used to require long meetings with salespeople, such as car sales, have adopted the automated sales approach. Think of the online auto-seller Carvana.

When this makes sense:

- For most consumer products. Businesses can lower their operational costs by eliminating internal sales departments and instead making the buying process automated while generating leads through advertising, marketing, and content.

- For B2B products that are easy to buy and deploy without much help from the seller. One common example is a web-based productivity app that a business buyer can sign up for and begin using immediately.

When this doesn’t make sense:

- For a complicated or technical high-touch sale, a B2B example could include selling IT infrastructure equipment to enterprises. A B2C example might consist of selling a backyard deck, or a kitchen remodel.

3. Resale distribution through select authorized dealers

Some companies want more market reach than their own in-house sales team, or an automated sales process can give them. In those cases, businesses choose to sell through a small group of authorized resellers or dealers.

When this makes sense:

- If a business believes resellers can sell its product effectively and in a way that preserves or enhances its brand reputation.

- When a business believes that a small group of dealers can reach more customers than the company could on its own.

- If a business wants to sell through a resale channel but wants to control which partners can sell its products and on what marketplaces they can sell them. Businesses do this to protect their pricing and brand perception in the market.

When this doesn’t make sense:

- In some cases, if a business sells a commodity product and wants to compete only on price, it can make sense to open up its resale channel and allow any seller to offer its products.

4. Resale distribution open to all resellers

If a product team wants to reach as much of the market as it can, as quickly as possible, they might choose to invite all resellers to offer their products on

When this makes sense:

- When a company is selling into a “take-up market,” meaning the product, they’re offering a new type of product, and competitors are selling their versions of the new product at the same time.

Under those circumstances, the business might decide it’s more important to capture market share than carefully vet each new resale partner and accept only the most reputable.

When this doesn’t make sense:

- If a business wants to protect its brand’s reputation in the marketplace. When reputation is a priority, a business might be willing to sacrifice some market reach and speed of sales in favor of vetting new resellers and limiting which ones it will allow representing its brand.

- If a business wants to create long-term relationships with its resale partners. If that is the company’s goal, allowing every interested dealer or wholesaler to sell its products could be counterproductive.

Too many sellers in the same geographic area, or on the same digital marketplace such as Amazon, will force each reseller to compete with all of the others and could drive down their margins. This could upset large and lucrative partners and convince them to abandon the company’s products.

Download The Product Strategy Playbook ➜

How Do Product Distribution Models Affect Product Management?

The product distribution model your business chooses can affect many of your decisions as a product manager. A few examples:

1. Your approach to building and updating the product

If you’re creating a digital product such as software, will you sell it as a web app or as a downloadable piece of software your customer will need to install?

Those choices will guide your team’s decisions about how to develop the product and how often you’ll update it. (You can push live updates to a web app more often than you can change an installed product on your customers’ computers or servers.)

2. Your onboarding strategy and tools

If you’re planning to sell your product through an assisted sales process, you can expect your sales reps, sales engineers, and post-sale account managers to handle a lot of the training and onboarding for your customers.

But if you’re planning to sell via an automated process—requiring little or no direct communication between your team and customers before they buy—then you’ll need to build onboarding tools and content that allow users to guide themselves through the training process.

3. Your approach to research and validation

For a consumer product such as fitness equipment, your target market will consist of an enormous number of prospective customers. You’ll want to conduct massive amounts of industry research. Study market trends, recent changes in consumer preferences for fitness products, and which products are succeeding. You’ll be looking for a product idea with broad appeal.

But if you’re planning to build a complex, expensive product for large enterprise customers, you will take a different approach. Because your target market is relatively small, you will want to spend as much time as possible talking directly with potential buyers and end-users at those companies. And keep in mind, your buyer persona and user persona at an enterprise company will often be different people. You’ll want to talk with both.

What Does a Product Distribution Strategy Look Like?

Here are the steps you will want to take when developing your team’s product distribution strategy.

Step 1: Learn how your target consumer shops and buys.

If you’re selling a digital productivity app for a large business, you want to learn how those buyers—say, a Chief Technology Officer or Vice President of Operations—source new products for their companies.

Step 2: Study your competitors.

If you’re not sure the best way to distribute your products, look at how your competitors are doing it today, their strategies might give you some ideas or inspiration for your company. In analyzing the competition, you might discover that they’re employing a flawed product distribution strategy. In either case, you’ll gain some valuable business intelligence.

Step 3: Determine how much each distribution approach will cost.

The cost of your product sales strategy will play an essential part in your decision. If an assisted sales force appears to be the most lucrative option—but it is cost-prohibitive right now—you might instead opt to create a small resale channel and work only with reputable, expert resellers.

Step 4: Consider each approach’s impact on product development.

As discussed above, the product distribution model you choose will affect other decisions your product team makes, including how to research and build the product. If you have a specific plan in mind for product development, you will want to take that into account when choosing a product distribution strategy.

Step 5: Don’t forget your brand’s reputation

Selling through a resale channel means your customers’ opinions about your product, and your company will be based partly on how your reseller treats them. Also, if you have too many sellers competing against each other in the same places for the same customers, that could lead to price erosion and other problems that could undermine your brand value.

So whatever product distribution strategy you choose, you need to take into account how it could enhance (or harm) your brand in the marketplace.

Learn more about bringing your product to market: