The insurance industry has been around for a long time—but today’s insurance industry isn’t a stodgy affair. It’s home to lots of innovation, challenges, and digital transformations that would intrigue any enterprise product manager.

Roadmaps for Product Managers in the Insurance Industry

Product managers in the insurance industry must deal with four distinct audiences: customers, licensed agents, external appraisers, and corporate employees. Each has very different needs, not to mention a broad range of subject matter expertise. More importantly, one cohort has an internal channel back to product management while the other parties don’t.

Balancing the needs of each user type requires an extra level of sophistication in product prioritization and planning. Internal stakeholders must be aligned, not only around their preferences but those of their customers and the rest of the insurance ecosystem.

As a powerful tool to align stakeholders, product roadmaps paint the big picture for teams that may be unaware of the broader ramifications of the product strategy. There’s nothing better suited for providing a broader context to explain why you’re doing what you’re doing. Moreover, given the longer timelines that some of these initiatives require, roadmaps also set expectations and provide updates as to how things progress.

Making an Effective Roadmap

The product roadmap doesn’t start with dates and specifics. It begins with a vision. It addresses why you’re building something and what you hope to accomplish. The rationale should be clear and specific.

The entire organization and all the stakeholders must both understand and buy into this vision and its’ intent to align with the organization’s objectives. It requires conducting conversations with everyone before the process begins to uncover their motivations, priorities, and concerns. With this foundation, the work can commence identifying which initiatives move the product closer to this shared vision.

Insurance industry-specific metrics

If you can’t measure it, there’s no way to know if you’re successful. But each industry has its own ways of measuring success. For a product in the insurance industry, this largely depends on which part of the ecosystem it serves.

Despite how many commercials are on TV, consumers aren’t purchasing insurance products all that often. Generally, only life events—like marriage, having kids, or buying a new house or car—motivate them to do so. While there might be some savvy shoppers always looking for a better deal, it’s mostly a set-it-and-forget-it mentality.

Given that dynamic, customer-facing products likely have two sets of metrics that matter. The first is ensuring prospects turn into customers. These will be similar to any “sales funnel” operation where you’re continually trying to move prospects through the sales pipeline.

You’ll want to measure (and improve upon) how many prospects research policies, request quotes, and eventually sign up as customers. One complicating factor can be independent sales agents.

Customers might begin on your website. But when they’re ready to get a quote or make a purchase, they’re often redirected to contact a local broker. Successfully linking the activities happening before that with the policies eventually sold by those brokers can be pretty tricky. It possibly requires the definition of success as only getting to that point in the funnel.

For this industry, churn equals “policy retention.” A company-wide metric worth watching, and also attributable to specific products that touch policyholders.

Consumers interact with their insurance companies beyond their purchase decision. When things go awry, they’re filing claims, working with adjusters, and pursuing payouts for damages and repairs. As unhappy people dealing with personal crises, they’re looking for a simple, easy, and stress-free as possible.

Retention

Linking the retention rate of customers interacting with different policy holder-facing parts of the product (be it the website, apps, AI-driven chatbots, etc.) helps measure the effectiveness of those tools at retaining them. Of course, few people cancel their policies on the spot even if they’re miserable, so the units of measure might come in months and years versus days.

Outside partners and internal users, such as brokers, appraisers, and adjusters are the “customers” for other products. Defining success metrics for these areas is also essential. These may be more subjective, such as satisfaction with the experience. Still, there’s the opportunity for some quantifiable measures, including conversion rates for brokers and accuracy, and speed/performance improvements for internal apps used to process claims.

Queueing it up

With success metrics defined, utilize prioritization frameworks that get a more diverse array of people involved. You’ll get a broader range of perspectives plus since they participated in the process, there’s more transparency making them more inclined to support those decisions since they feel heard and included.

After determining items with the most significant impact potential for achieving the company’s goals, it’s time to group these initiatives into themes. Using themes instead of listing specific features and enhancements has many benefits, particularly for products with so many stakeholders.

Themes elevate the debate from the merits of one feature versus another, putting everything into a context of what really matters in terms of hitting objectives. Theme-based roadmaps also remove an obsession with dates and timelines from the equation. While there may still be key milestones along the way, replace the handwringing over exactly when things will ship with a big picture mentality.

Roadmaps for product managers in the insurance industry won’t look like one at a startup, and cybersecurity and regulatory issues are a big part of that equation. Compliance requirements, changes in standards, reporting needs, and the like are real things that you must factor into many products, even though many stakeholders do not value them. Keeping this as a consistent theme on the roadmap ensures they’re accounted for early enough that they don’t create retroactive issues or get short shrift during resourcing and prioritization.

Download The Product Roadmap Strategy Playbook ➜

Appearances matter

Finally, it’s time to think about the presentation and formatting of your roadmap. Standard apps like PowerPoint and spreadsheets aren’t up to the task of making your product roadmap shine.

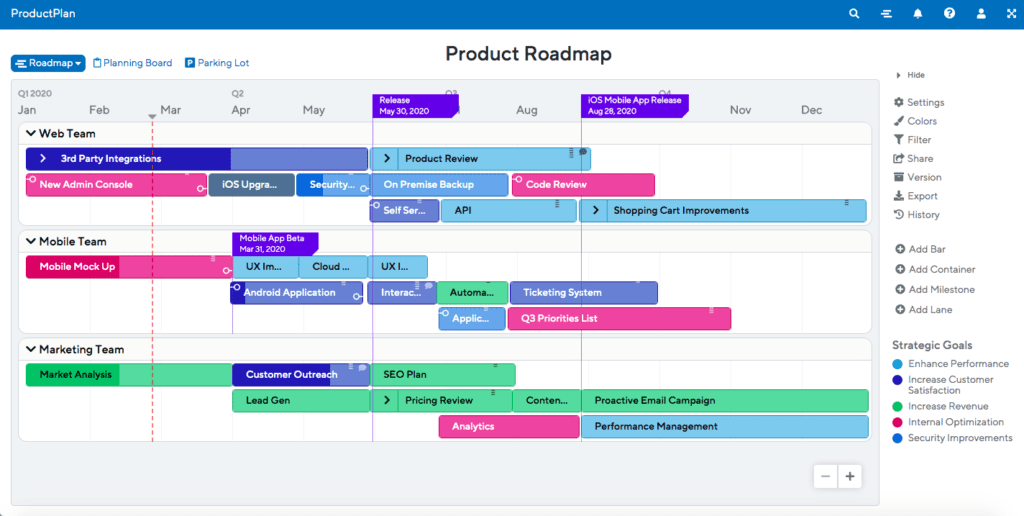

Using a visual roadmap format, the key concepts of the roadmap take center stage. They emphasize themes, milestones, and outcomes and are easily customized to present a relevant view for the audience you’re presenting it to.

Tailoring your roadmap to specific groups helps keep the focus on the issues they care about. While engineering needs details, executives can stay high level while focusing on projected outcomes and impacts on KPIs. With the right tool, the same roadmap can serve as a foundation for each variant, minimizing the labor to spin out different versions.

Maintaining Your Roadmap

Creating “version 1.0” of your roadmap is a lengthy process. However, afterward, it becomes a living document that you continually review and update accordingly. If you don’t stay on top of it, an outdated roadmap can remain in circulation. This inaccurate view sets false expectations to stakeholders, development teams, and even customers and partners.

It’s particularly crucial in the insurance environment. The products are big and complex, with lengthy timelines. Lots of people who show interest in the product are probably not close to it day-to-day. The roadmap is the best way to keep them informed.

Try establishing a regular cadence for reviewing and revising things. When making updates, be sure to inform everyone. Ideally, take any old copies out of circulation, which happens automatically when relying on a tool with support for online viewing. It’s even better when those updates to automatically push out to the rest of the organization via Slack.

In such a large organization, it’s also critical to plug the product team into any shifts in strategy. Although sometimes challenging, you must bring those changes to the product team’s attention. Otherwise, the product roadmap could take the product in a direction not aligned with corporate objectives.

Build Your First Visual Product Roadmap ➜

Communicating the Roadmap

Customized views of the roadmap for different audiences is just the starting point to connect with stakeholders across the organization. Product managers have many tools at their disposal for socializing the roadmap and educating everyone about what’s included and what it means for the business.

From one-on-one reviews with key internal folks to all-hands meetings, a well-made roadmap is a perfect vehicle for launching a presentation on vision, product strategy, desired outcomes, and the North Star metrics guiding this work.

Taking on the challenge of developing, maintaining, and communicating a product roadmap may seem daunting. But roadmaps will make your life as a product manager in the insurance industry much easier in the long run.